Expat life checklist for 2022: moving abroad, relocating, taxes, savings, mental health

Expats are experts in checklists. From moving abroad preparations to daily life admin stuff. If they made it so far successfully (of course failures included too, and hardship), it means they have the disciple to keep things organized. Sounds familiar? Are you one of them? Anyway, what’s next in 2022? How does the new year impact an expat life and what checklists do we need as expats for a smooth 2022? First, please consider unpredictability is part of any checklist in 2022, but a “healing” and promising year is awaited. We’ve looked at predictions for 2022 from several perspectives, and made checklists for a bunch of things: moving abroad, relocating, taxes, savings, satisfying mental health. What we can state for sure is that MobileRecharge.com and MobileRecharghe app are still available for your mobile credit transfers back home, as fast as… a glittering bullet or a full-of-adrenaline Speedy Gonzales. Sorry for the comparison, nothing else on our mind at this moment.

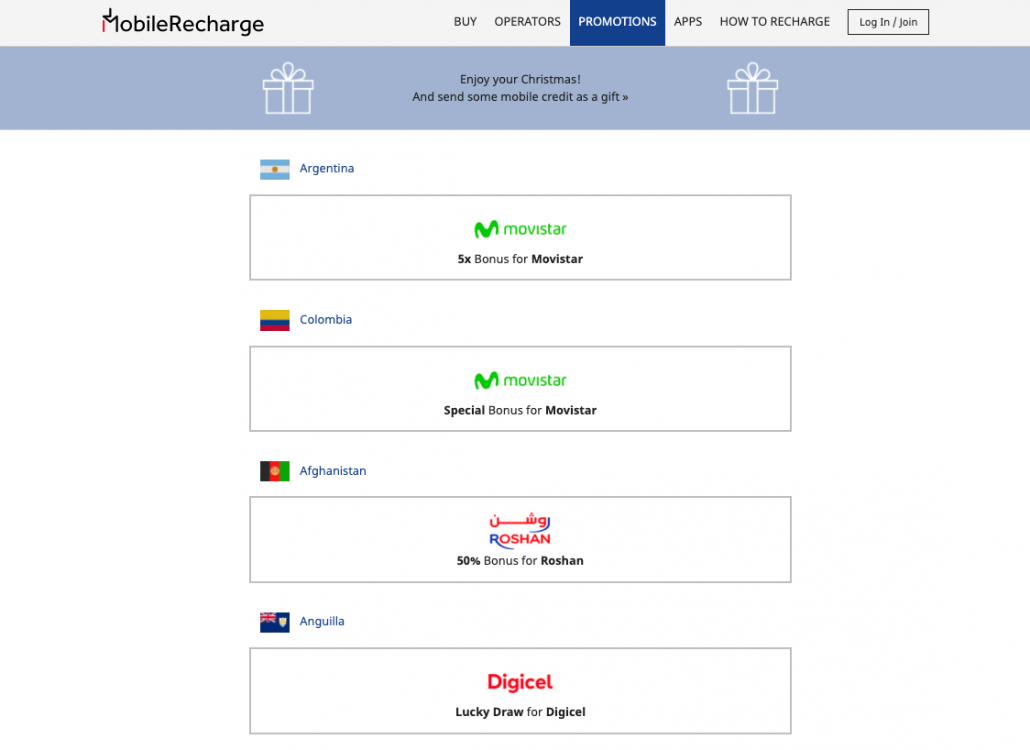

Oh, before we jump into checking lists, PROMOS for EXPATS are ready for your New Year or Christmas useful gifts.

Moving abroad checklist

Photo credits: Guilherme Stecanella on Unsplash.com

Expat life starts even before moving abroad. The following checklist covers the essentials for relocating to a foreign country. Expats-to-be, enjoy what many experts in travel and living overseas suggest…

- Passport (check expiration)

- Visas

- Photocopies of important documents, and email copies; birth certificate or a copy of it, medical records and vaccinations, a copy of graduation/education certificate, etc)

- Travel paperwork documents

- Travel insurance. Some bloggers recommend World Nomads Travel Insurance.

- Determine your budget: traveling expenses, lodging for 3 months at least, sending luggage with SendMyBag.com, or similar services, etc.

- Choose an overseas banking system

- Set credit cards and banks

- Find accommodation

- Research and decide on a medical care program

- Get a medical insurance

- Add necessary medication to your luggage

- Research what vaccinations are required

- Clothing

- Transportation

- Language

- Travel blogging preps if you plan to take advantage of your new adventure.

- 30 days in advance medical appointments before leaving. Maybe even a preventative physical check.

- Dental check.

Techie stuff…

- Electronics

- Cell phones and your next carrier plus online communication; you should have it ready when you’re there, you’ll need it for everything you do (jobs, accommodation, family, Google maps, and so on). We recommend using PhoneClub or KeepCalling for international calls, MobileRecharge to keep your home phone running, and Tello for domestic calls within the USA and even international calls.

- Shipping. SendMyBag.com is our latest finding, very proud of them.

- Canceling your home lease and find a place for all your stuff while your gone (friends, parents, etc).

- Cancel home memberships. Except maybe for your phone number that you could still keep running for when you visit as a prepaid not a post-paid plan; feed it with credit from time to time on MobileRecharge.com. ;)

- If you’re an American citizen, consider the Federal and State taxes for the following year. When you start making an income abroad, you’ll have to look into the new taxes and what/how you’ll pay in the US or your new country. Anyway, keep your bills for possible deduction!

Taxes checklist if you’re an expat in the USA

Photo credits: ben o’bro on Unsplash.com

Expat tax planning for 2022 is helpful for any relaxing expat lifestyle. Not that you will be fully prepared, but at least you have big and small picture.

- Keep an eye on the possible changes in 2022 to carry out your Expat Tax Planning Process

There are a number of tax changes that President Biden has proposed (not passed yet) that could impact expats, such as:

-

- Global minimum tax rate of 15% for corporations

- Surtax on very high earners

- Expanded Medicare tax that would apply to pass-through entities

- More IRS enforcement

- An increase to the SALT limits (State and Local Tax)

- Gather docs for a smooth expat tax process in 2022

Find your documents that demonstrate how much time you spent in the US during 2021. You’ll know if you qualify for the money-saving Foreign Earned Income Exclusion (FEIE), which allows you to exclude $108,700 for your 2021 taxes, and $112,000 for 2022. Cool!

- Reduce your tax liability by donating via Form 1040 Schedule A

You can reduce your tax liability by donating to eligible charities favored by the IRS. Include the donation on your Form 1040 Schedule A. But, you can only claim the deduction the year that the organization receives your donation. IRA contributions are tax-deductible, so, the more you contribute, the less income you’ll have to pay tax for.

Good mental health expat checklist

2022 is said to be still in pandemic mode (sorry to tell you that). For many expats that means less-to-no traveling back home (again). Remember that in 2021, many people working and living abroad felt more isolated than the rest who could visit their families every few months. Right? So, then, having the online chance to connect with their folks and old friends is vital. That would be on the checklist. Keep in touch!

Back to 2022, although economists see a lot of issues, numerologists and astrologists see many solutions. 2022 is according to many such approaches a healing time, with medical solutions and a new paradigm when it comes to relationships. So, we have the COVID 19 risks on one hand, plus that special share of challenges in society for expats. So, here’s a list of smart things to consider to stay mentally nice.

How we react… is the key

Whether expats are more likely to develop anxiety due to pressures associated with living abroad is relative. Because it’s HOW WE REACT to situations that makes all the difference. And not the situations themselves. But expat life has a strong longing that may be risky, especially on holidays when family is back in the home country. Specialists have also identified an isolation feeling among expat spouses, who experience loneliness after following their partner to a new country without friends or a new job.

Whatever the context, there are plenty of…

Ways to keep the mind and soul cool and relaxed

- Connecting with the family online (we recommend also KeepCalling for international calls or Tello for USA cheap and high quality plans)

- Identify opportunities: jobs, self-development courses (rediscover yourself in a new context)

- New hobby or more time investment in an old passion

- Meet the locals, get new friends: neighbors, Facebook groups, workshops based on common interest

- Expose yourself to new situations:

- Watch feel-good movies

- Move around to exercise or find new places/visit

- Stay child-like, focus on the present, dream big about the future, don’t stumble on the past. Forget it if you need it (for a while at least)

Savings checklist

Photo credits: Towfiqu Barbhuiya on Unsplash.com

Our favorite topic because we operate in the expat savings field somehow. We’re talking money here right? Expat life includes a constant comparison of prices here with prices there, in. the mother country. Different currencies, different habits, you know the story… If things are invented out of laziness most of the times, optimized tools for expats arise thanks to the need to save. And many foreigners in the USA, Canada, Australia or New Zealand or UK, come with a habit to save thanks/due to home country limits. Here’s a list.

Saving money…

- Look for expat deals

- Look for the most economical tools

- Choose expat-friendly services like Tello and MobileRecharge

- Create a budget with MUST expenses and leave room for a flexible WOULD-BE-NICE-TO-HAVE list. You gain control by putting down the split of needs and wishes.

- Put away each month automatically; in your bank app make a setting to withdraw a certain amount from your salary and transfer it in your economy deposit for rainy days, vacations or investments.

Keep an eye on tax requirements

Stay in the know when it comes to laws that can affect your finaces, especially those relating to taxes and investments of your home country. You’re still a citizen of your country, so you’ll still be affected by certain tax laws. Keep in touch with someone back home who is well informed, or follow some news pages in your motherland.

Keep records of your expenses

We think this is a good way to learn about your spending behavior and improve it for your own benefit. Let’s put it differently. How to meet your needs and use your money smartly, to serve you and not a consumerism trend. That includes seeing your budget with different eyes.

Tracking certain goods or service categories is useful. What’s gonna be your priority? Rent first and clothing? Rent, taxes, and entertainment? Entertainment and groceries? Don’t laugh, answers differ from one person to another! :)

Compare the market

It’s normal to get a bit confused and even scared the first few weeks or months after moving abroad. Things may seem a bit messy, disorganized. Study the market a bit, don’t fall for the first offers that come your way, like network and phone providers. If you were to ask us, we’d go for Tello US Mobile on GSM. Very flexible, cheap, and super fair; phones on sale and frequent promos. Could be the best on the market. Anyway, they rate the best on Trustpilot.

Ask those close to you for their opinions and compare your options. Get help finding the best places to shop for groceries, toiletries and clothes, or you could just look around and compare prices and draw up your own conclusions.

Keep your expat life simple

The stoics say there is no misery if you only live to your means. If your current living standard differs from the past, we’d say adapt fast to avoid false expectations and suffering. If it’s super higher, we’d say never forget the past and play smart.

Saving time?

Connect to your fellow expats

Well, that saves money and time because while taking to other expats you get smart info into the system, avoiding the hassle of struggling on your own. It’s the benefit of sharing ideas and tips on money-saving opportunities. Plus, it’s not theoretical. The advice comes from direct experience.

Work close to home

Of course, it saves money, but it also saves valuable time, which (let’s face it) became a luxury. This may not always be possible, but try and work as close to home as possible. So, you cut off transport costs, especially if the company you work for doesn’t give you a travel allowance. But imagine the time you can use doing other stuff instead of commuting. We’re talking hours in many cases…

DIY

There are things worth doing yourself if you can or are open to learning. You’ll discover new stuff about yourself, save money and get some exercise in… Well, you know better. Instead of buying overly-priced food from restaurants or expensive take-out stuff, you can cook fast yourself. There are plenty of easy and quick recipes. Check Ramsey and you’ll never fail. ;)

Wash your own laundry yourself, it also saves time and money. You can do other fun stuff while waiting. It’s not like you’re washing the laundry at the river… manually.